Lately, drones have change into more and more prevalent throughout numerous industries, from aerial pictures to surveying and supply providers. As drone expertise advances, so does the necessity for accountable drone possession. One essential side of dependable drone operation is insurance coverage. This weblog put up will delve into drone insurance coverage, masking what it’s, why you want it, and find out how to shortly receive it utilizing AutoPylot.

What’s Drone Insurance coverage?

Drone insurance coverage is a sort of insurance coverage protection designed to guard drone homeowners/operators from monetary losses ensuing from accidents, injury, theft, or legal responsibility claims associated to the operation of their drones. Identical to automobile insurance coverage, drone insurance coverage insurance policies can differ in protection and price relying on elements equivalent to the worth of the drone, its supposed use (private or industrial), and the extent of protection desired.

Forms of Drone Insurance coverage

Legal responsibility Insurance coverage:

Legal responsibility insurance coverage is a elementary part of drone insurance coverage, masking third-party bodily harm or property injury claims that will come up throughout drone operations. Whether or not it’s an unintentional collision with an individual or injury to somebody’s property, legal responsibility insurance coverage helps cowl the authorized and medical bills related to such incidents.

Hull Insurance coverage (Bodily Injury Protection):

Hull insurance coverage focuses on the drone itself, providing protection for damages ensuing from accidents, crashes, or technical malfunctions. Notably invaluable for industrial operators, hull insurance coverage mitigates the monetary affect of repairs or substitute, permitting operators to recuperate swiftly from unexpected damages.

Insurance coverage for Different Tools (e.g., Payload Insurance coverage):

One of these insurance coverage extends protection past the drone to guard invaluable attachments like cameras and sensors. Payload insurance coverage safeguards in opposition to potential injury or loss, making certain that high-value tools stays financially protected. Particularly vital for operators utilizing specialised payloads, this protection enhances the general threat administration technique for drone operations.

Why You Want Drone Insurance coverage

Danger Mitigation

Like several expertise, drones are vulnerable to numerous unexpected occasions, equivalent to technical malfunctions, climate challenges, or human error. Drone insurance coverage is an important threat mitigation device, offering operators with a security web for sudden accidents or incidents. With insurance coverage, operators can confidently navigate their flights, figuring out that potential accidents are coated.

Monetary Safety

Accidents occur, and the monetary implications will be important after they contain drones. The monetary burden will be overwhelming, whether or not it’s injury to third-party property, bodily harm claims, or repairs to the drone itself. Drone insurance coverage affords monetary safety, making certain the operator will not be left shouldering the full price of authorized charges, medical bills, or drone repairs. This safety is particularly vital for industrial operators, because it safeguards the monetary well being of their enterprise in opposition to unexpected incidents.

Unlock Extra Drone Jobs

Insurance coverage is commonly a prerequisite for securing contracts and jobs for these working drones professionally. Purchasers and companies hiring drone providers sometimes require proof of insurance coverage as a part of their threat administration protocols. By having complete insurance coverage protection, operators meet these consumer necessities and place themselves as accountable and dependable professionals within the trade. This, in flip, enhances their credibility and will increase their probabilities of securing extra drone jobs.

What Drone Insurance coverage Can Cowl

- Third-party bodily harm

- Third-party property injury

- Bodily injury to the drone

- Bodily injury to different tools

- Theft of the drone

- Lack of payload or tools

- Medical bills

- Further pilots

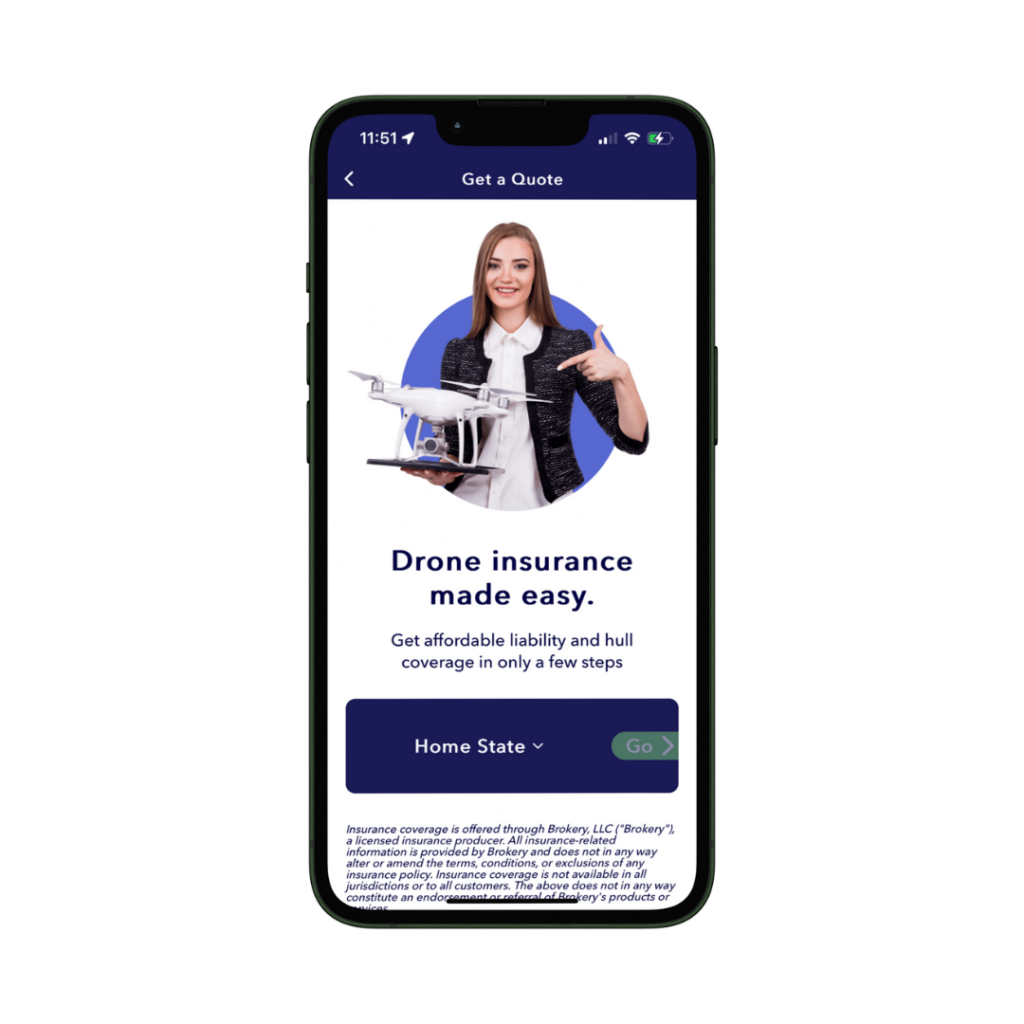

Easy methods to Receive Drone Insurance coverage with AutoPylot

One of many advantages of flight planning with AutoPylot is that, along with being an FAA-approved supplier of B4UFLY and LAANC providers, operators can buy drone insurance coverage with out ever leaving the app.

Right here’s how you need to use it:

- Obtain AutoPylot: Begin by downloading the AutoPylot app on iOS or Android.

- Get Insurance coverage: From the menu, navigate to insurance coverage.

- Enter your state: Choose your private home state to see if protection is avalible. Keep in mind, AutoPylot is including new states weekly!

- Obtain a quote: Full the appliance by inputting the legal responsibility restrict you want, including hull insurance coverage, and telling us about your self.

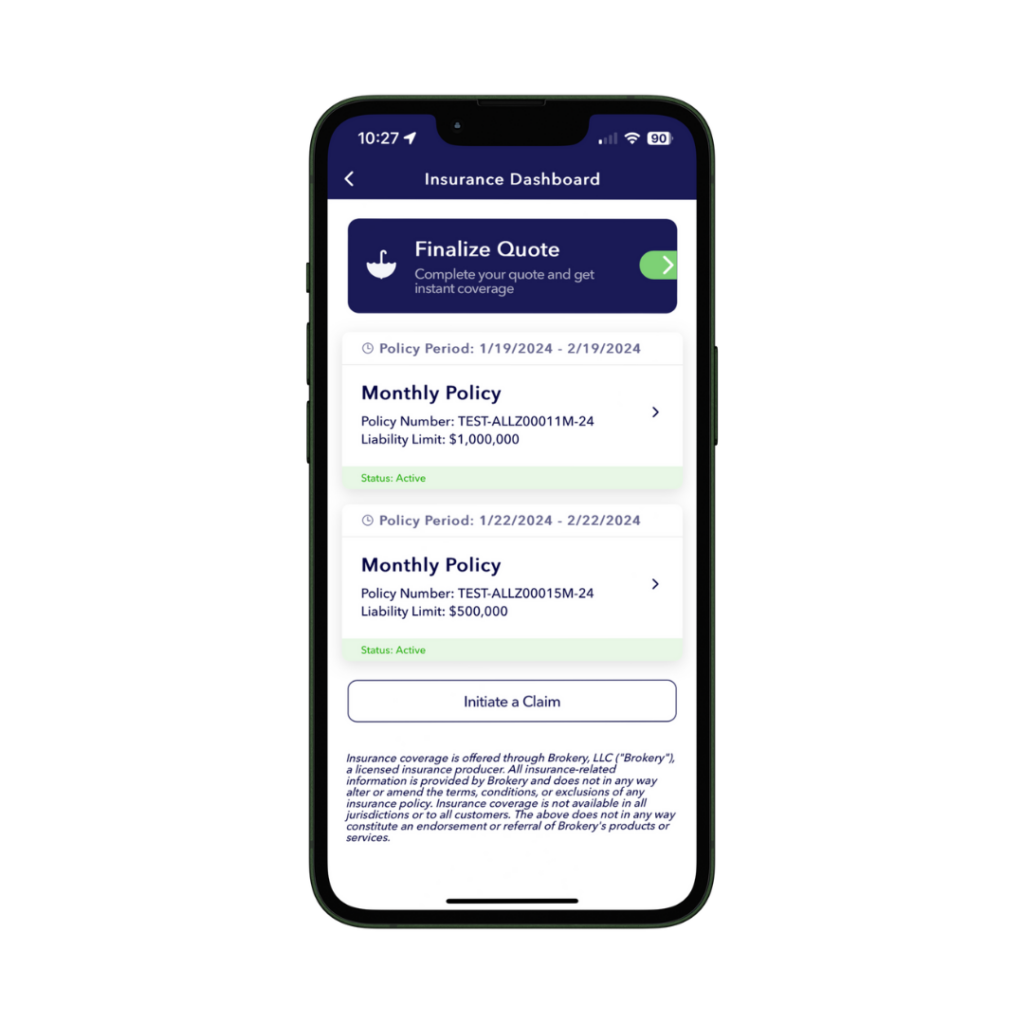

- Buy protection: Choose between a month-to-month coverage or take pleasure in some financial savings with an annual coverage.

- Entry Coverage: Now you can simply entry your coverage and its paperwork from the insurance coverage dashboard.

As the recognition of drones continues to soar, accountable drone possession consists of securing the correct insurance coverage protection. Whether or not you’re a hobbyist or a industrial operator, understanding the varieties of protection accessible and why you want it’s important. With the comfort of platforms like AutoPylot, acquiring drone insurance coverage has at all times been difficult, offering drone lovers and professionals with the safety they should navigate the skies safely and responsibly.